- ул. Горького, ул., 21 8170855

- ул. Горького, ул., 21 8170855

- ул. Горького, ул., 21 8170855

- ул. Горького, ул., 21 8170855

- E-mail: moskva@prodam-okno.ru

Безгэ ышаналар, инде 10 елдан артык!

- Калькулятор окон

- Вызов на замер

- Получить скидку

Пластиковые окна Москва

Любой ремонт в квартире редко обходится без замены старых деревянных окон на пластиковые конструкции. Дерево является долговечным материалом, но оно достаточно быстро изнашивается и стареет со временем. Постоянное окрашивание рамы также не делает окно более привлекательным и ускоряет процесс износа. Кроме того, все деревянные окна пропускают в квартиру шум, пыль и холод, поэтому хозяева вынуждены все время решать данные проблемы.

Замена деревянных окон на пластиковые позволяет улучшить теплосбережение в квартире. Кроме того, данные конструкции обеспечивают шумоизоляцию помещений и отличаются легкостью в уходе. Их не нужно постоянно красить и заклеивать на зиму. При необходимости очищения окон их можно просто вымыть мыльным раствором и смазать подвижные элементы фурнитуры.

Пластиковые окна обеспечивают также безопасность всех проживающих в квартире. Для этого они снабжаются специальной антивандальной фурнитурой, которую невозможно взломать. Решетки на окна также не нужно ставить, поскольку стеклопакеты практически нельзя разбить. Дизайн пластиковых окон является еще одним их преимуществом, так как покупатели смогут легко выбрать любую форму и цвет конструкции.

Большой популярностью сейчас пользуются окна из немецкого профиля VEKA. Они способны сделать жизнь более спокойной и комфортной на многие годы. Если поставить эти окна, можно забыть про шум, пыль и сквозняки в квартире. Профиль VEKA отличается гарантированно высоким качеством. Эти оконные системы выпускаются только в оригинальном исполнении.

Наша компания занимается установкой пластиковых окон в Москве и во всем Москве. Благодаря огромному опыту работы и использованию продуманной системы контроля качества наши изделия соответствуют самым высоким требованиям клиентов.

Мы предлагаем окна, которые изготавливаются из профильных систем самых популярных производителей мира. На всех этапах производства наша компания применяет автоматическое оборудование известных марок, что является гарантией получения качественных изделий очень высокой точности.

Наши преимущества:

- предоставление консультаций квалифицированных специалистов;

- возможность познакомиться с ассортиментом товара благодаря постоянной экспозиции окон;

- использование всех типов оплаты за заказанный товар;

- предоставление рассрочки оплаты на полгода;

- доставка окон точно в указанные сроки благодаря наличию собственного грузового автотранспорта;

- установка пластиковых окон монтажными бригадами в соответствии с ГОСТом;

- предоставление длительной гарантии на все выполненные работы по монтажу окон – 3 года;

- гарантия на изделия составляет не менее 40 лет;

- сертификация всей продукции и наличие паспортов качества; доступная цена.

Наша компания предлагает приобрести пластиковые окна в офисах продаж в Москве или сделать заказ на выезд мобильного офиса. Наши консультанты во время выезда предложат свою помощь по выбору нужной конструкции окна по индивидуальным размерам и требованиям заказчика. При этом замеры окна производятся совершенно бесплатно. В каждом конкретном случае заключается договор, что является гарантией качества самих изделий и выполняемых нашими специалистами работ по установке.

В ассортимент нашего интернет магазина входят не только качественные пластиковые окна, но также алюминиевые и пластиковые двери высокого качества. Мы предлагаем своим клиентам и другие услуги, в частности, остекление и отделку балконов и лоджий, остекление промышленных помещений, остекление дач и коттеджей под ключ.

КАЧЕСТВО ВСЕГДА ПОБЕЖДАЕТ!

Компания Века-мск предлагает клиентам качественные пластиковые окна в Москве и Москве, качественные алюминиевые и пластиковые двери, а также комплекс услуг "под ключ", включая остекление и отделку балконов и лоджий, остекление дач и коттеджей, а также остекление промышленных помещений.

Лучшие пластиковые окна - для Вас! лучшие пластиковые окна - это не самые дешевые и не самые дорогие.

Лучшие окна - те, которые смогут решить Ваши проблемы.

Свежий отзыв

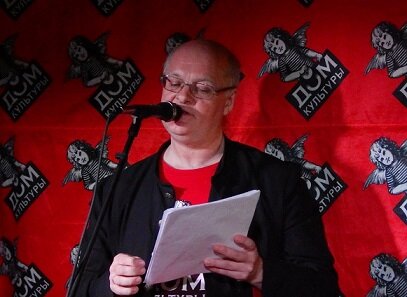

Я известный музыкант, флейтист групп "Аквариум" и "Наутилус", сейчас живу в Москве и являюсь руководителем оркестра в театре "Ленком". Летом 2016 года я узнал о возможности сотрудничества с компанией Вeka Москва. Результат превзошел все ожидания. Высочайшего качества окна для загородного дома были изготовлены по моей просьбе с опережением срока, оперативно доставлены и грамотно смонтированы. Отмечу, что на стадии формирования заказа очень важными оказались профессиональные и точные консультации сотрудников фирмы по размеру, дизайну и потребительским свойствам окон Beka. Сложные задачи подбора нужных характеристик окон помогли решить директор Елена и менеджер Лиана, общение с ними было не только плодотворным, но и по-человечески приятным. Обязательно буду сотрудничать с ними и дальше!

Я известный музыкант, флейтист групп "Аквариум" и "Наутилус", сейчас живу в Москве и являюсь руководителем оркестра в театре "Ленком". Летом 2016 года я узнал о возможности сотрудничества с компанией Вeka Москва. Результат превзошел все ожидания. Высочайшего качества окна для загородного дома были изготовлены по моей просьбе с опережением срока, оперативно доставлены и грамотно смонтированы. Отмечу, что на стадии формирования заказа очень важными оказались профессиональные и точные консультации сотрудников фирмы по размеру, дизайну и потребительским свойствам окон Beka. Сложные задачи подбора нужных характеристик окон помогли решить директор Елена и менеджер Лиана, общение с ними было не только плодотворным, но и по-человечески приятным. Обязательно буду сотрудничать с ними и дальше!Олег Сакмаров

Фото наших работ

Фото наших работ Новинки

Новинки Распродажа

Распродажа Суперпредложения

Суперпредложения